DermWorld

Dermatologists discuss the possibilities — and pitfalls — of ChatGPT in clinical practice.

Dermatologists discuss the influx of new JAK inhibitors in dermatology and how they are breaking new ground for the specialty.

Pulling back the curtain on PBMs for transparent drug pricing.

Academy coding staff address important coding topics each month.

DermWorld’s physician editor interviews the authors of recent dermatologic studies.

Each month, DermWorld tackles issues “in practice” for dermatologists.

DermWorld covers legal issues in “Legally Speaking.”

Ask the Expert: John Barbieri, MD, MBA, FAAD, discusses important changes to the iPLEDGE program.

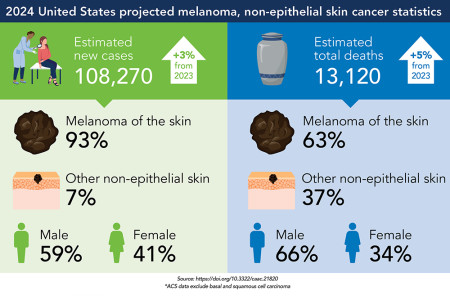

Skin cancer incidence and related deaths projected to rise in 2024.

What has caused it, and what resources can help? Dermatologists discuss solutions.

Recent advances in vitiligo treatment and research open doors for physicians and patients.

Physician editor Kathryn Schwarzenberger, MD, previews this month’s issue.

Members of DermWorld’s Editorial Advisory Workgroup share exciting news from across the specialty.

Academy President Seemal R. Desai, MD, FAAD, discusses his goals for his term as president.

How do I claim CME credit form the AAD Annual Meeting?

Find a Dermatologist

Find a Dermatologist

Member directory

Member directory

2024 AAD Innovation Academy

2024 AAD Innovation Academy

AAD Learning Center

AAD Learning Center

Need coding help?

Need coding help?

Reduce burdens

Reduce burdens

Clinical guidelines

Clinical guidelines

Why use AAD measures?

Why use AAD measures?

Latest news

Latest news

New insights

New insights

Physician wellness

Physician wellness

Joining or selling a practice?

Joining or selling a practice?

Promote the specialty

Promote the specialty

Advocacy priorities

Advocacy priorities